Snaxshot Touches Down in NYC

An Interview with Andrea Hernández of Snaxshot on her thoughts on the current state of CPG food & beverage products.

GM everyone hope you’re all having a great morning.

The Fancy Food Show is happening right now in NYC, bringing together some of the most interesting products in CPG food & beverage under one roof.

Friend of the newsletter, PJ Monte, founder of Monte’s Fine Foods, has one of the best decorated booths there. And Andrea Hernández of Snaxshot is on the ground as well. She’s throwing a Night Market tonight at Dr. Smood where you’ll be able to try some up and coming brands and meet founders/investors in this space.

I invited her on the newsletter today to give her thoughts on the Fancy Food Show, the CPG space, and how she grew Snaxshot into what it is today.

In Today’s Newsletter—

Andrea Hernández from Snaxshot on her thoughts from NYC’s Fancy Food Show

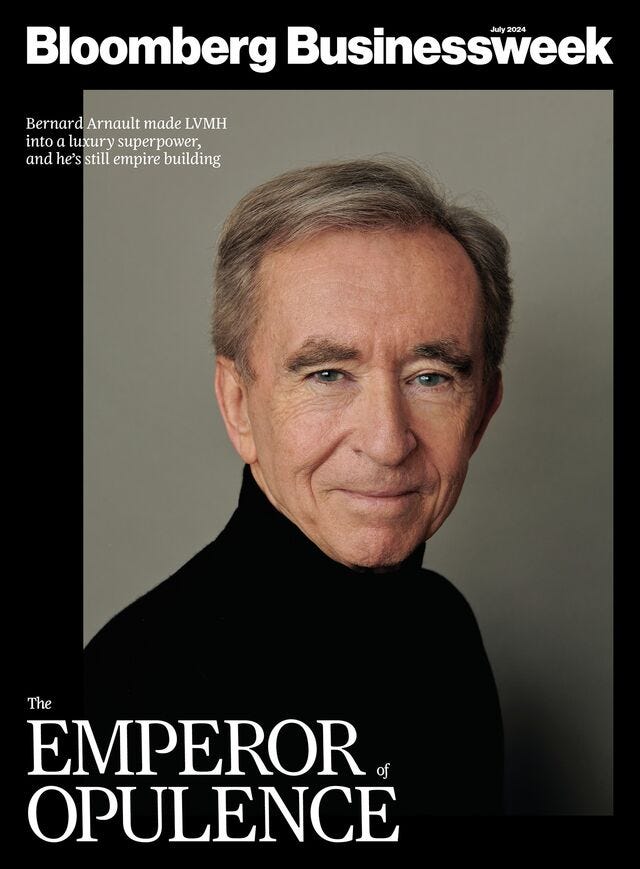

A Look Inside Bernard Arnault’s mulit-billion dollar fashion conglomerate

Andreseen Horowitz Launches a PE Fund

Nvidia Employees Stock Selloff

Skims x the Olympics

A CHAT WITH WITH ANDREA HERNANDEZ

Jake Bell: Any interesting highlights you’re seeing across food & beverage during your trip?

Andrea Hernández: My observations from this convention: Food innovation in taste and texture is happening in Japan, Korean snacks as a category in US is growing.

JB: I’ve been talking with a lot of founders and investors behind the scenes who are predicting a contraction in the space as we’ve seen the CPG market become heavily saturated. Any thoughts or predictions on this?

AH: Yeah, we reported on Ampla’s shutdown as a credit lender, which used to be the easy money route a lot of these CPG brands defaulted when VC wasn’t available. CPG isn’t tech, and I’m glad the market correction is here to remind us of it.

JB: You and Snaxshot as a whole have been on fire lately. Can you give me a background on how you got started and became such a renowned figure in this space and what keeps you passionate?

AH: Found a niche, double downed on it. Most of the media in this space was on two sides of spectrum industry vs the PR puff piece around these products I wanted to be able to write objectively but also having fun with it, while staying authentic and doing my own due diligence to parse through what feels like BS in pro of consumers.

JB: What can attendees expect at the Night Market on Tuesday?

AH: A sneak peek of new brands not yet available in retail or pre-launch, our events are usually curated to bring you the new and exclusive before they get picked up by your classic shoppy shops or other retailers, but also it’s a way of supporting founders early on, while having a good time! There will be a variety of NA and cocktails, small bites and of course snack sampling through the night!

Go follow Andrea here and Snaxshot here for expert reporting, insights, and previews of the hottest new CPG brands in food & bev.

NEWS

Bloomberg profiled the (sometimes) richest man in the world. Bernard Arnault is the CEO of LVMH, the largest luxury conglomerate in the world, where he oversees an expansive portfolio of brands across fashion, beauty, and real estate. The profile is expansive, shining light on his daily routine (he works from 8am-8pm), his potential plans for one of his several children to succeed him, and the business practices that led him to be dubbed ‘the wolf in cashmere’

It really is an incredibly, in-depth look at how he has grown LVMH and amassed a net worth of $200B+ and become the richest man in the world, depending on how the market is moving that day. Some of my favorite highlights are—

LVMH was one of the first luxury brands to make a big bet on the Chinese market. Arnault recalls when they opened the first Louis Vuitton store in 1992, he visited China and was initially skeptical, seeing the lack of infrastructure. But the bet paid off, China has become one of the brands biggest markets and the company was able to benefit from the enormous economic book in the three decades since.

Despite a luxury sales slump (U.S. direct to consumer luxury spending was down 7% last year) Arnault does not seem worried. He says the company is focused on 2030.

The way in which former and current employees speak on Arnault is fascinating. He’s particularly demanding and detail oriented. Every Saturday he spends his days surveying the luxury empire’s storefronts, giving notes for improvement to managers. He called out a Tiffany employee for wearing regular Air Force’s, not the Tiffany x AF1 collaboration shoe.

LVMH has grown so large due to Arnault’s ability to consolidate a fractured luxury market under his control. He’s taken over massive brands like Tiffany, raised prices, hired Cartier’s former head of jewelry design, drafted celebrities like Jay-Z and Beyonce for marketing campaigns, and has increased average customer orders from $500 to $2000 on average.

LVMH’s private equity arm, L Catterton, is working to expand its real estate holdings across the world. Their strategy is simple, purchase a storefront in a major area, take the best spot for their own brands, and force competitors to move out once their lease term ends. This is why we’ve seen competitors like Prada begin to acquire important real estate such as their $385M property on 5th Ave.

Nvidia employees are cashing out as their equity has surged. Nvidia, has gained an astounding $3T in market value in the last 20 months, and if you were an employee with stock options, you’re now most likely a millionaire. I saw some eye watering statistics saying Nvidia is now worth over $100M per one of their 30,000 employees. But the rising price leaves Nvida employees with equity with a champagne problem: cash out now or see if the stock continues its meteoric rise? Many employees are hedging their bets, selling off major portions of equity and keeping some invested just in case. Disclosures paint an interesting picture, as employees cash out and become absurdly rich, while outsiders try to buy in while the stock is highly valued.

Andreessen Horowitz is launching a private equity fund. One of the world’s largest venture capital funds, a16z, is looking to raise funds for a PE venture. The new fund has raised over $822M so far, according to disclosures, and shows an interesting shift in the firm’s investment strategy. Marc Andreessen and Ben Horowitz initially made their mark investing in early stage tech/internet companies (Coinbase, Instacart, Airbnb) I am very curious to see what kind of companies they will buy and try to supercharge growth.

Skims is releasing an Olympics collection. Kim Kardashian’s successful clothing brand has been on point with dropping collaborations that fit the cultural moment. Whether it be the companies Valentine’s Day collection, which featured Lana Del Rey, or the brand becoming the official underwear sponsor of the NBA, Kardashian and her team have their fingers on the pulse. In typical fashion, the brands new Olympics collection makes a ton of sense. The new collection is modeled by Team USA athletes and will drop in time for the upcoming games in July. Smart rollouts like this are why Skims is valued at $4B.

Thanks for reading today’s letter! I’ll see you guys at the Night Market tonight.

Jake Bell is a content marketing, creative strategist, and designer based in NYC. He specializes in brand building, content creation, branding, art direction, creative strategy, and making things cool.

Want to chat? Email me: jake@jb.studio