Big Finance is Coming for the Creator Economy 💰

Inside BlackRock's Influencer Event and a New Fund for Creators

Note: Nothing in this newsletter should be construed as financial advice.

20 years ago, when I was in elementary school and teachers asked the class what they wanted to do when they grew up— commons answers would be: astronaut, scientist, doctor, president, now 57% of Gen Z list ‘becoming an influencer’ as a primary career aspiration.

Given the shifting media landscape, can we really blame them?

The creator economy is currently valued at around $250B, and on track to reach $480B by 2028. Additionally, 44% of advertisers are planning on spending more on creator / influencer advertising this year.

And its hard to deny that ‘influencers’ shape consumer perception and have huge sway in getting people to buy products and services.

I was asked recently how a new product launching in the US soon should start its marketing rollout… and I told them not to waste a ton of money on a massive celebrity endorsement, and instead set up relationships with smaller creators with highly engaged audiences.

Today, your favorite podcaster, vlogger, or writer on Substack has significantly more influence on your purchasing decisions than a massive SoHo billboard of Kendall Jenner wearing Calvin Klein.

And with any booming market, it was only a matter of time before big finance and other legacy institutions started poking around.

Inside a BlackRock Influencer Event

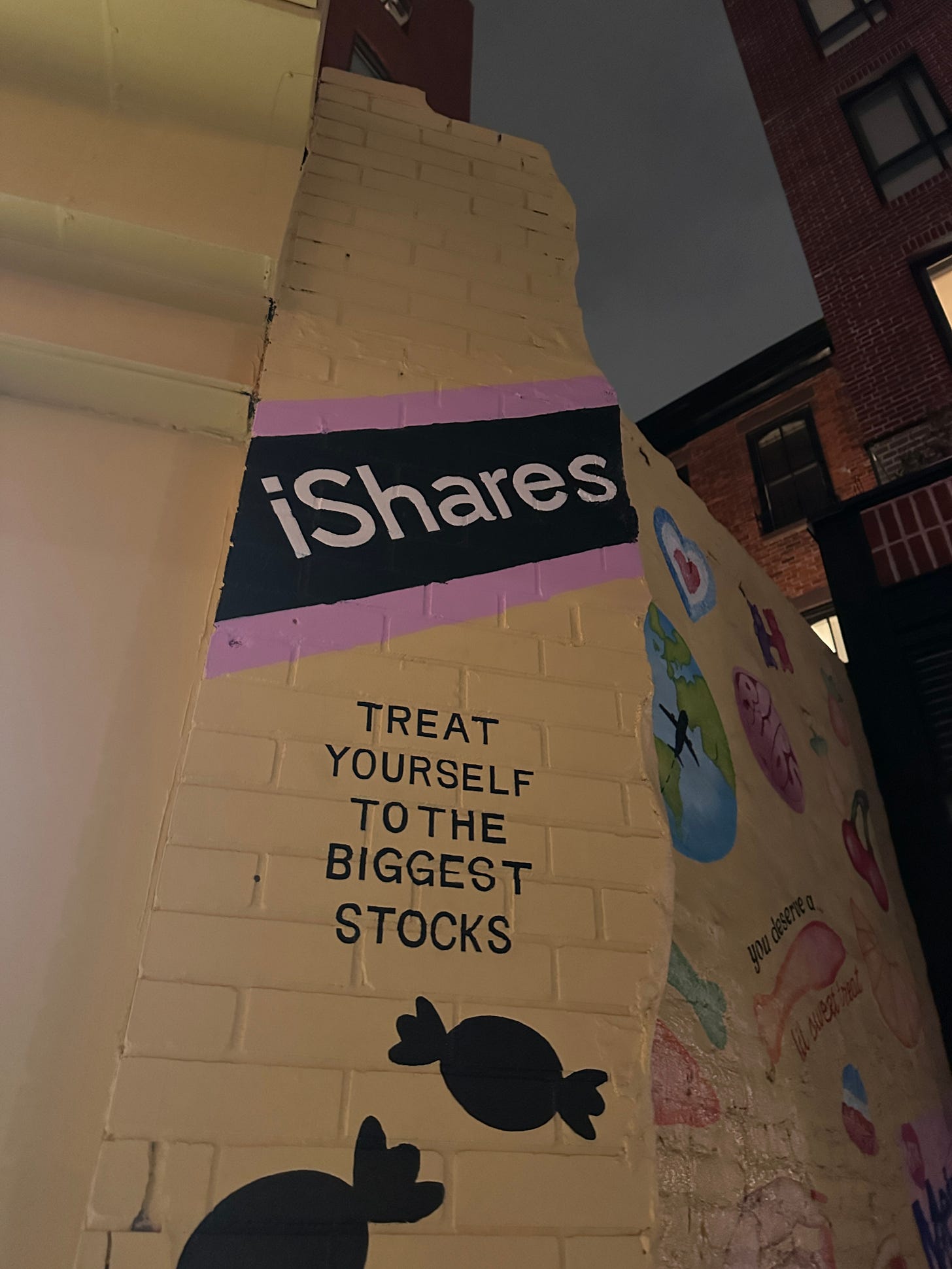

Last week, iShares invited me to an event in the West Village to celebrate their new ETF TOPT: a collection of 20 of the largest companies in the US (Apple, Amazon, Nvidia, etc.)

For context, iShares ETFs are managed by BlackRock, one of the largest investment management companies in the world.

I was really excited and curious about the event, as someone who invests and cares about financial wellness.

The event was like most ‘influencer’ events I get invited to each week— vibey wine bar or restaurant, branded napkins and cups, and a partnership with Lil Sweet Treat, a candy store founded by Elly Ross.

My takeaway is that this new ETF and Lil Sweet Treat are similar in that people can get a mixed bag of all of their favorite stocks (or candy) with just one investment.

On the surface, I think this makes total sense and was actually a nice metaphor. I ate some candy, had some wine, talked to people about what they’re up to, then I went to American Bar and got a burger.

Should Financial Institutions Be Using Influencers?

But I was surprised to see a massive amount of curiosity, skepticism, and hate around this ‘BlackRock’ influencer event the next morning.

This visceral reaction struck me— we are marketed each and everyday by influencers, what made this different?

I reached out to numerous friends who work in finance— who raised concerns around the potentiality of regulatory guidelines around having influencers give financial advice.

I wanted to get to the bottom of this, so I started looking at the regulations around marketing:

BlackRock, and all other major investment institutions, are carefully analyzed by the FTC and FINRA, which has laid out pretty clear guidelines for influencer promotions:

Fair and Balanced Content: FINRA’s Rule 2210 mandates that promotional content must be fair, balanced, and not misleading. Influencer posts that make exaggerated or misleading claims or are otherwise biased are in violation. This includes avoiding “promissory language” that might give potential clients unrealistic expectations

Supervision and Approval Requirements: Firms are required to supervise influencer-generated content and retain records of communications. FINRA enforces strict guidelines to ensure that firms using influencers have systems in place for reviewing, approving, and archiving all promotional posts

Privacy and Consumer Protection: Under Regulation S-P, firms must protect consumers' nonpublic information and provide clear privacy notices. FINRA’s oversight includes ensuring that influencers do not share sensitive data improperly and that firms offer clear opt-out options for customers concerning their data use

Compliance with Transparency Requirements: Influencers must disclose their financial relationships with firms, and the SEC has been particularly active in penalizing firms for inadequate transparency about such partnerships. This includes making disclosures about incentives or bonuses given to influencers for customer referrals

🚨 I do want to make clear, iShares DID NOT instruct influencers to promote TOPT or give any investment advice to their followers in any capacity 🚨

Ultimately, creators simply went and were made aware of the event. What they did after is up their prerogative.

This event was the first of its kind as far as I could tell, and I wanted to get more information on iShares’ influencer strategy, and how they ensured it was compliant with strict regulations.

They declined to comment on specifics saying they’re focused on key initiatives related to the product launch.

All this is to say, I don’t know how I feel about this quite yet.

From a marketing perspective, I think financial institutions need to adapt to changing media landscapes just like any other brand, and part of that involves working with influencers. I’ve seen some people on TikTok say this was a good idea—

Tiktok failed to load.

Tiktok failed to load.Enable 3rd party cookies or use another browser

On the other hand, there is a lot of room for error and misinterpretation when working with influencers who are not equipped to give financial advice.

I am really curious what you guys think of this— should big financial institutions be using influencers to market their products?

A $100M Credit Fund for Creators

On the other side of the industry, big financial companies are also developing new credit funds to help fuel creators.

Lucky Hand Capital serves to keep influencers and creators funded. If you’ve done any brand work, you know that payment terms often favor the brand as opposed to the creator, leaving people waiting 30-90 days to receive payment for deliverables.

Lucky Hand is changing this— offering a new way for creators to get paid faster by uploading their invoice documents to the platform.

And just last week they launched a $100M creator fund, offering a unique opportunity for content creators to secure capital based on future earnings, leveraging a fully digital, simple, streamlined process to convert receivables into cash within 48 hours.

I spoke with Vanesa Atala, Head of Investor Relations at Lucky Hand Capital, to learn more about the fund and how it can help creators.

JAKE BELL: First off, can you give my readers a summary of what Lucky Hand Capital does and the inspiration behind starting this service?

VANESA ATALA: Lucky Hand is an innovative fintech company focused on providing receivables financing to influencers and content creators. Our digital platform simplifies access to capital, allowing creators to secure funding efficiently and in less than 48 hours. Most often, creators can receive payment the same-day.

With the fast-growing creator economy, there have been significant shifts in how quickly content is being monetized, yet the speed in which payments are being made to creators hasn't entirely caught up. Our receivables-based financing allows creators to secure capital based on their future earnings, effectively bridging the gap caused by lengthy payment cycles. This means creators can access funds within 48 hours, enabling them to continue producing high-quality content without financial delays and reducing the stress associated with cash flow management.

JB: Payments and liquidity are always a struggle in the life of a creator, how does Lucky's new fund help address this?

VA: This is exactly the problem that we're trying to solve with Lucky Hand LP – we're making it easier for creators to get the money they need when they need it. With just a few simple steps in our fully digital platform, creators can tap into their future earnings and get cash in hand within 48 hours. This means no more stressing over delayed payments—creators can keep doing what they do best: making amazing content and growing their community without any financial hiccups.

JB: What size creators is the fund anticipating servicing?

VA: Our fund is designed to cater to a diverse range of creators, from emerging influencers to established content producers. We target to provide financial solutions to Micro (10k to 100k Followers) and Macro Influencers (100k -1M Followers)

We aim to support creators of various sizes, recognizing that both smaller and larger creators face unique financial challenges in the creator economy. By providing tailored financing solutions, we can help empower all types of creators to scale their businesses.

JB: Walk me through a scenario in which a creator may find Lucky Capital's new fund useful?

VA: A micro-influencer has secured multiple brand partnerships but is experiencing delays in payment from past partners, causing cash flow issues. They need immediate funds to cover production costs for upcoming partnerships. By utilizing our services, the creator can upload a few easy documents and with just a few clicks, quickly convert their future receivables into cash.

Within 48 hours, they have the money needed to continue producing content without interruption, allowing them to maintain momentum, fulfill their brand commitments, and scale their business.

JB: Data shows 14% (27M) of the US workforce is involved at least part-time in the creator economy, but the average salary is just $51,000: is the goal of this new fund to potentially help creators turn their part-time hustle into a sustainable revenue stream / business model?

VA: Our goal is to alleviate the financial pressures that can often otherwise hinder sustainable business growth. By offering quick access to capital, we aim to help creators – whether it's a part or full time job – invest in their projects, expand their offerings, and ultimately build a more stable revenue stream.

With the right financial support, we believe that creators can unlock their full potential and thrive in this dynamic creator economy.

Both the BlackRock influencer event and Lucky Hand’s new creator fund are early glimmers into a post-influencer world for financial institutions.

Whether it be holding a PR event in the West Village, or launching a fund to support creator endeavors— these massive institutions are not living under a rock anymore.

They’re adapting, changing strategies, meeting audiences where they’re at, and leveraging the growing creator economy.

It’s not a question as to if we want this or not— its going to keep happening regardless— rather these precedent setting events open more questions like:

What happens if an influencer markets a stock that results in their followers facing significant financial loss?

Do influencers want to assosciate themselves with big financial institutions?

Can they work together to properly disclose paid relationships in the future?

Which creators should take funding?

These are all questions I don’t know the answer to. So I want to get your thoughts—

What do you think of big finance coming for the creator economy?

Let’s chat in the comments.

Jake Bell is a content marketing, creative strategist, designer, and writer based in NYC. He specializes in brand building, content strategy, creative direction, business development, and making things cool.

Want to chat? Email me: jake@jb.studio

I'm pretty distrustful of huge financial companies, and that clashes with the personal credibility that influencers and creators are supposed to leverage. The devil is in the details but I don't see how the two can coexist